Creating win-win in debt resolution for banks & borrowers

Increase Recovery Rates. Decrease Collection Costs. Be 100% compliant

3 easy steps

Your AI Debt Collection Agency - All at the click of 1 share button

Step 1: Send us defaulter list in an Excel Spreadsheet

It's as easy as that. We got it from here

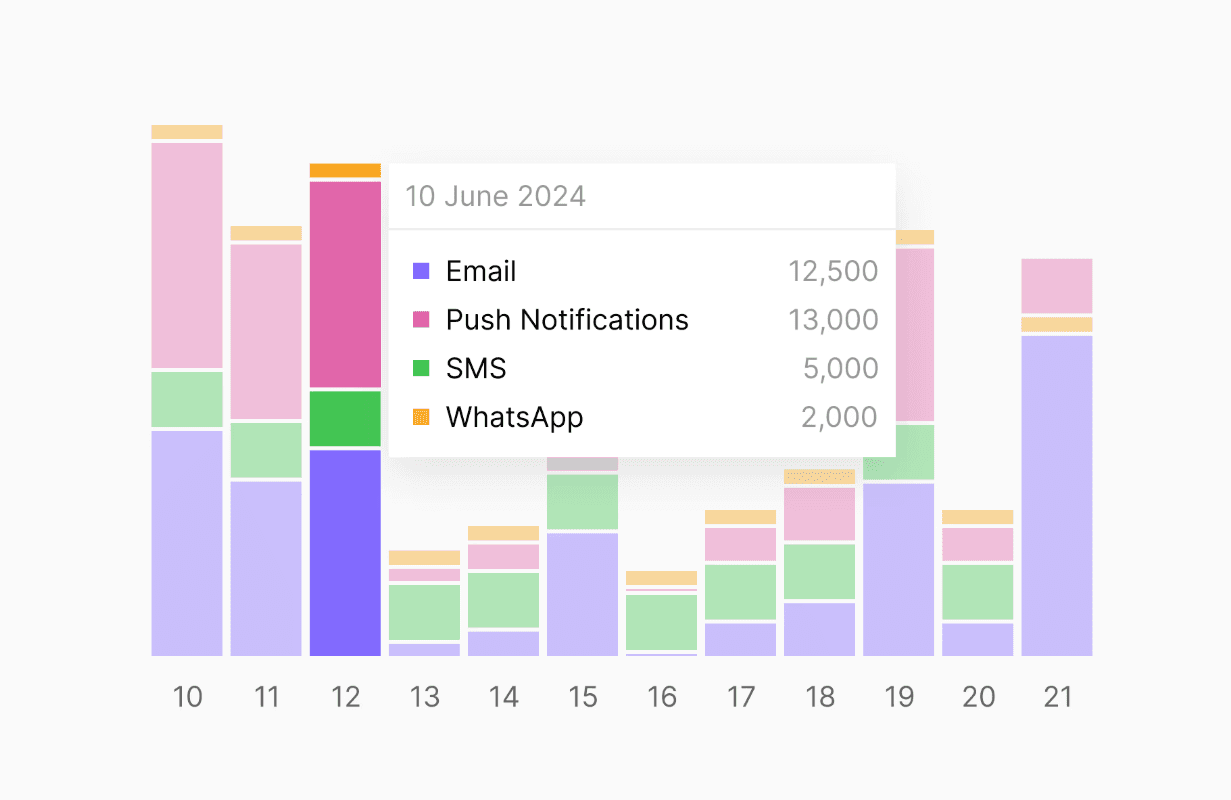

Step 2: Our AI reaches out to your customers via WhatsApp/Email/Calls

We pick the right time, tone, channel and language to talk to your defaulters

Step 3: Improve collection strategy

Continuously monitor campaign performance and iterate each day

"Our AI agent interacts with your borrowers, where they reply and keeps you constantly in the loop of recovery rates"

Feel free to mail us for any enquiries : abhishek@riverline.ai